Cost Drivers Examples In Service Industry

What is a Cost Driver? A cost driver is the direct cause of a Cost Structure Cost structure refers to the types of expenses a business incurs, and it is typically composed of fixed and variable costs.

Fixed costs are costs that remain unchanged regardless of the amount of output a company produces, while variable costs change with production volume., and its effect is on the total cost incurred. For example, if you are to determine the amount of electricity consumed in a particular period, the number of units consumed determines the total bill for electricity. In such a scenario, the number of units of electricity consumed is a cost driver. Application of a Cost Driver in Computing a Product’s Cost In a business venture, the major determinant of whether there will be continuity or discontinuity is cost. If the Product Costs Product costs are costs that are incurred to create a product that is intended for sale to customers. Product costs include direct material (DM), direct labor (DL) and manufacturing overhead (MOH). Understanding the Costs in Product Costs Recall that product costs include direct material, direct labor, and exceeds the revenue derived from a sale, there is a great probability of the business closing down.

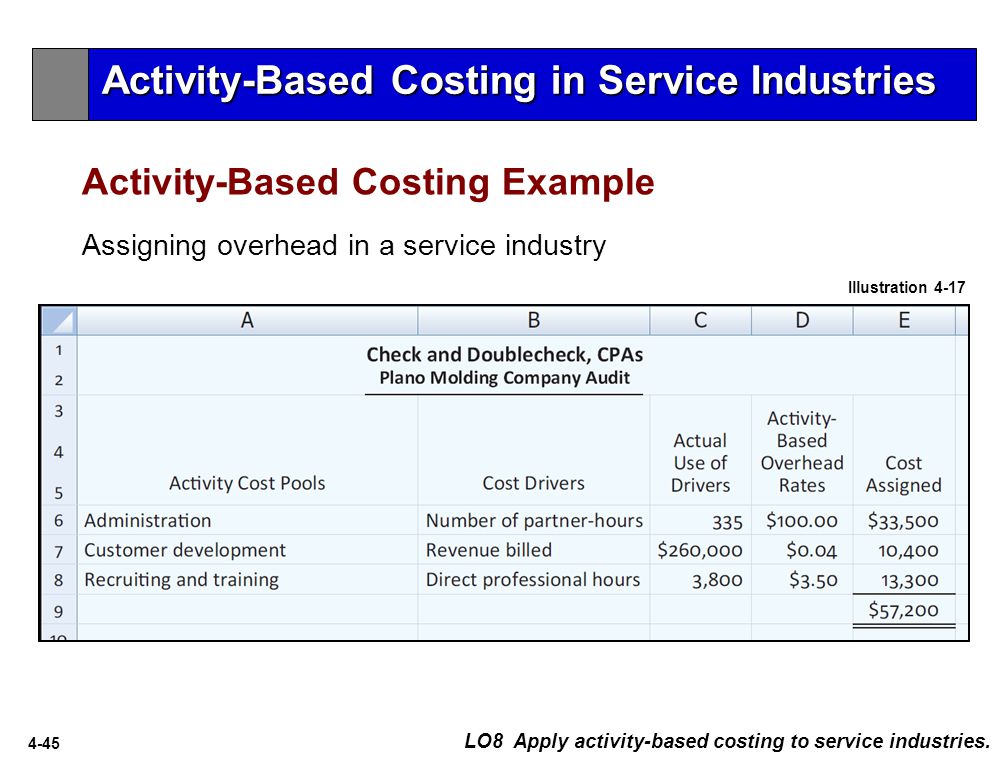

For this example, if the firm multiples total cost by 1.25 (a mark-up of 25% above total cost), then the average price of an audit engagement would be $46,724. Using a cost-driver approach, the firm would still allocate all of the direct costs of the engagements as shown in Table 2.

If the costs are less than Sales Revenue Sales revenue is the starting point of the income statement. Sales or revenue is the money earned from the company providing its goods or services, income, there is profit and a probability of expansion. If the costs equal revenue, then the business is at a point of indifference and it can be closed or continued depending on other variables apart from cost or on how costs can possibly be adjusted.

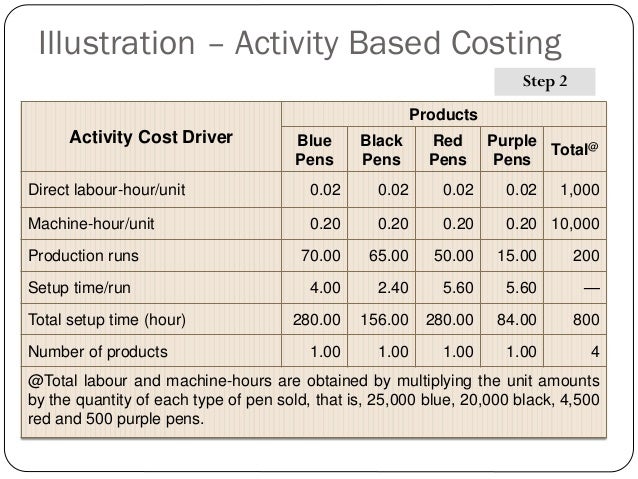

In order to make rational business decisions, you require viable costing methods to get the correct cost or a figure which is close enough to the actual cost for you to perform reliable cost/revenue analysis. Failure to do so can lead to the closing of a business venture, due to poor cost computation, that may actually be profitable, or at least potentially profitable. Total production costs are used to set the selling prices for particular products. Thus, if the costs are inaccurate, the profit forecasts will not be accurate, and the whole accounting system of the particular organization will be subject to errors. Our main focus here will be Activity-Based Costing Activity-based costing is a more specific way of allocating overhead costs based on “activities” that actually contribute to overhead costs.

An activity is an event, task, or unit of work with a specific purpose, whether it be designing products, setting up machines, operating machines, or distributing products. Therefore, activity-based costing considers all these potential activities.

Activity-Based Costing (ABC) An activity’s costs can be allocated to a particular production lot, and this makes activity-based costing a more accurate way of allocating both direct and indirect costs. It is a method of computing costs associated with each product or line of production in a company based on the amount of resources consumed by each activity. As a result, cost drivers are most relevant in the ABC costing system. The cost of each activity is apportioned to specific products or lines of production, based on cost driver’s resources consumed. A cost driver is a factor that creates or drives the cost of the activity.

DISCLAIMER: The data displayed here is user-generated. Serial actress deepa venkat wedding photos. We do not host any media files (video, audio or images) on our servers. We aggregate and link / embed publicly available content from other sites on the Internet. We are not responsible for the accuracy, authenticity, compliance, copyright, legality, decency, or any other aspect of the content of other sites referenced here.

It is the root cause of why a particular cost occurred. Activities consume resources while customers, products, and channels of production consume activities. Understanding this is fundamental to the cost allocation concept using cost drivers. The profitability of each customer can also be easily evaluated using cost drivers, and in cases of resource constraints, the less profitable order can be eliminated.

Resources should be allocated to the most profitable activities or in proportion to profitability. For example, in most operations machines are used and thus, the machine hours used determines the total cost of operating the machine depending on how much money is charged per hour.

The concert on March 11 went on. Download full album justin bieber journals.

If a person operates a machine for 10 hours at a cost of $10 per hour, then the total cost that will be charged to the output of that particular time is $100. The more labor hours used, the higher the cost. If the particular machine we are referring to requires maintenance costing $1,000 after operating 2,000 hours, then the maintenance cost per every hour of machine operation is 50 cents ($1.000/2.000 hrs.). Thus, machine hours can be classified as a cost driver. Another factor that determines total cost is the cost per hour. If the cost per hour is high, then the cost associated with the output will also rise. Many variables determine the cost of production.